tax benefit rule calculation

Of the 1000 refund you receive from Iowa 400 of it will be taxable on your 2017 federal return. The corporate tax rate as well as the tax amortization period are defined by country-specific tax legislations.

Selling Stock How Capital Gains Are Taxed The Motley Fool

The tax credit reduces your tax bill by that same 1000.

. So if you owed 1500 in taxes and then took a 1000 credit your tax bill would be 500 1500 -. Consider all the factors to find out whether youd be better off in another states plan. This is accomplished by calculating the discounted present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortisation charges in the tax calculation.

So the tax benefit you received from the 300 refund was only 225. IRC 111 would still serve to exclude 4000 of the refund from their 2019 income. Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not receive a tax benefit for the loss in a prior year.

What form of tax will be applied once the bond is sold. This is done by calculating the present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortization charges in the tax calculation. Tax amortization benefit rules can differ significantly between countries and they can also change over time.

Answer a few simple questions to see whether your state offers a tax benefit for 529 plan contributions and if so how much it might be. The Central Board of Direct Taxes Chairman PC Mody says that the new tax regime offers lower slabs without exemptions. Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax deduction versus the 13000 you actually claimed.

De Minimis Fringe Benefits. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction. 375 6 years 2250.

When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600. If the full 5000 refund were disallowed their limited tax deduction under the TCJA would drop to 9000 from 10000 resulting in an increase in taxable income and an increase in tax that can be traced to 1000 of the refund. If the amount of the loss was not taken as a deduction in the year the.

Keep in mind you can open a 529 plan from any stateno matter which state you live in. Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from 15000 to 14500 a difference of 500. Therefore the valuation professional must always consider the latest tax amortization benefit rules applicable as of the valuation date.

Tax benefit rule calculation Monday May 16 2022 Edit. C received a tax benefit from 500 of the overpayment of state income tax in 2018. Suffers a fire a few days after completion of a building that cost 500000 to build.

Incorporate the present value of tax savings due to amortization by grossing up the value from Step 1 by the resulting TAB factor. According to the new budget individual taxpayers can switch back and forth between the new tax regime and the old structure. Allocation of Purchase Price.

How to Calculate Tax Amortization Benefit. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the. Of course if you were not able to itemize for 2012 none of your state tax refund is taxable for 2013.

De minimis tax rule also applies to fringe benefits offered by employers. Thus C is required to include. That results in a 400 difference which is your tax benefit.

You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. If a state or local income tax refund is received during the tax year the refund must generally be included in income if the taxpayer deducted the tax in an earlier year. The tax benefit shown in the summary section is defined by the following equation.

Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if marked as deductible Prepaid Interest Points X decimal form of tax bracket all divided by 12 to get monthly benefit. You are given a 15-year bond with a face value of 1500 and it matures in six years. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayers federal income tax return.

This is because the amount deducted for income taxes that reduces regular tax to or below the AMT level does not produce a tax benefit because the AMT does not allow the deduction. Dividing this by the marginal tax rate for regular tax purposes 28 results in 646 the approximate amount of income taxes that did not produce a tax benefit. 529 State Tax Calculator.

Value the asset in the absence of amortisation benefits. Equivalently stated taxpayers must include in income any amounts recovered if they received a tax benefit in a prior year for that loss. The TAB is calculated by using a two-step procedure.

2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayers federal income tax return. The entire amount recovered in the current year had given the taxpayer a tax benefit. State Local Tax SALT In Rev.

Legal Definition of tax benefit rule. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year. The new income tax calculations were announced with the new budget on 1 st February by FM Sitharaman.

If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. Then apply step 2. The business mileage rate for 2022 is 585 cents per mile.

The steps are shown below. The tax amortization benefit factor or TAB factor is the result of a mathematical function of a corporate tax rate a discount rate and a tax amortization period. The tax amortization period might be different from the useful life.

Tax Benefits Of Charitable Donations 2022 Turbotax Canada Tips

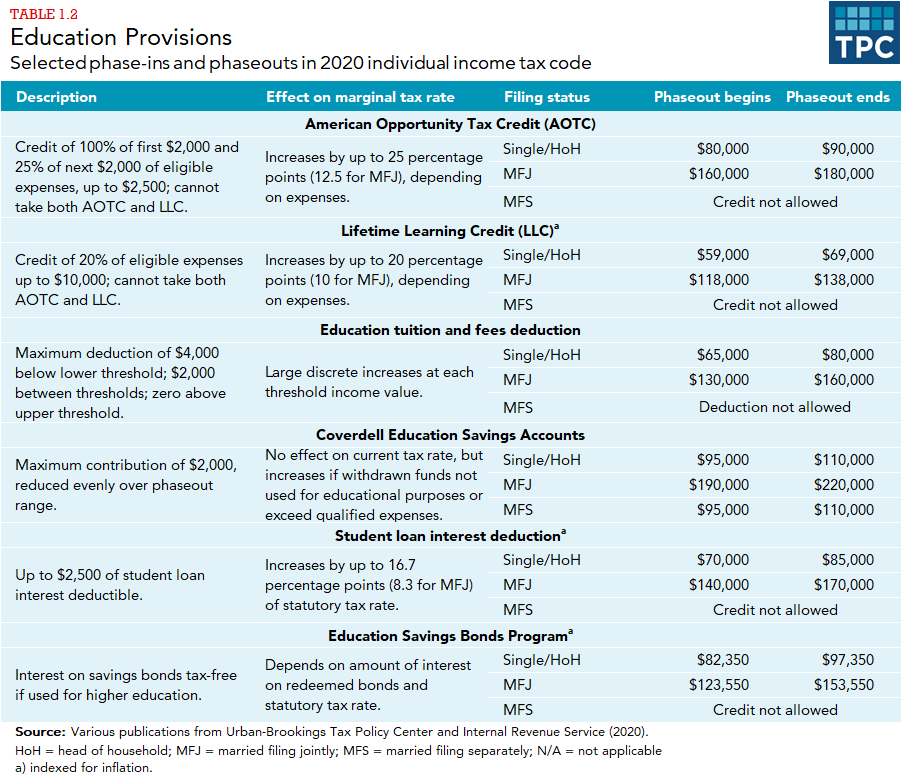

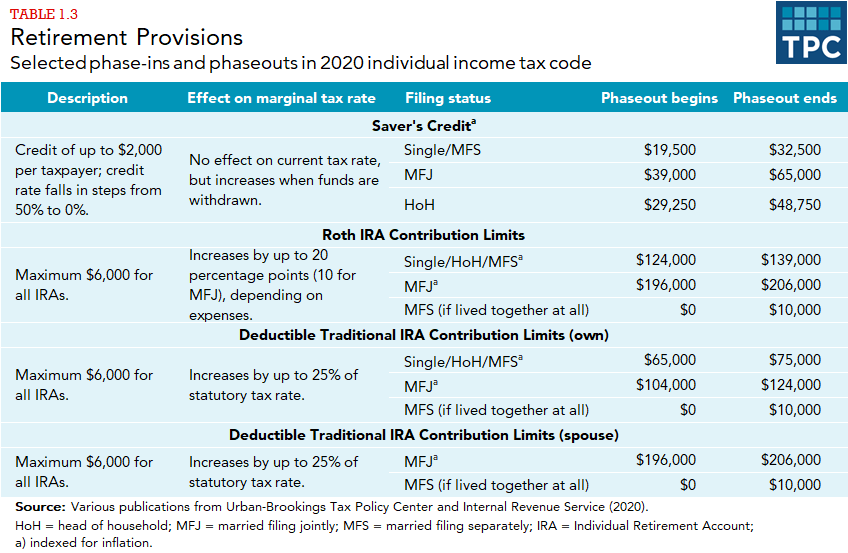

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Tax Shield Formula How To Calculate Tax Shield With Example

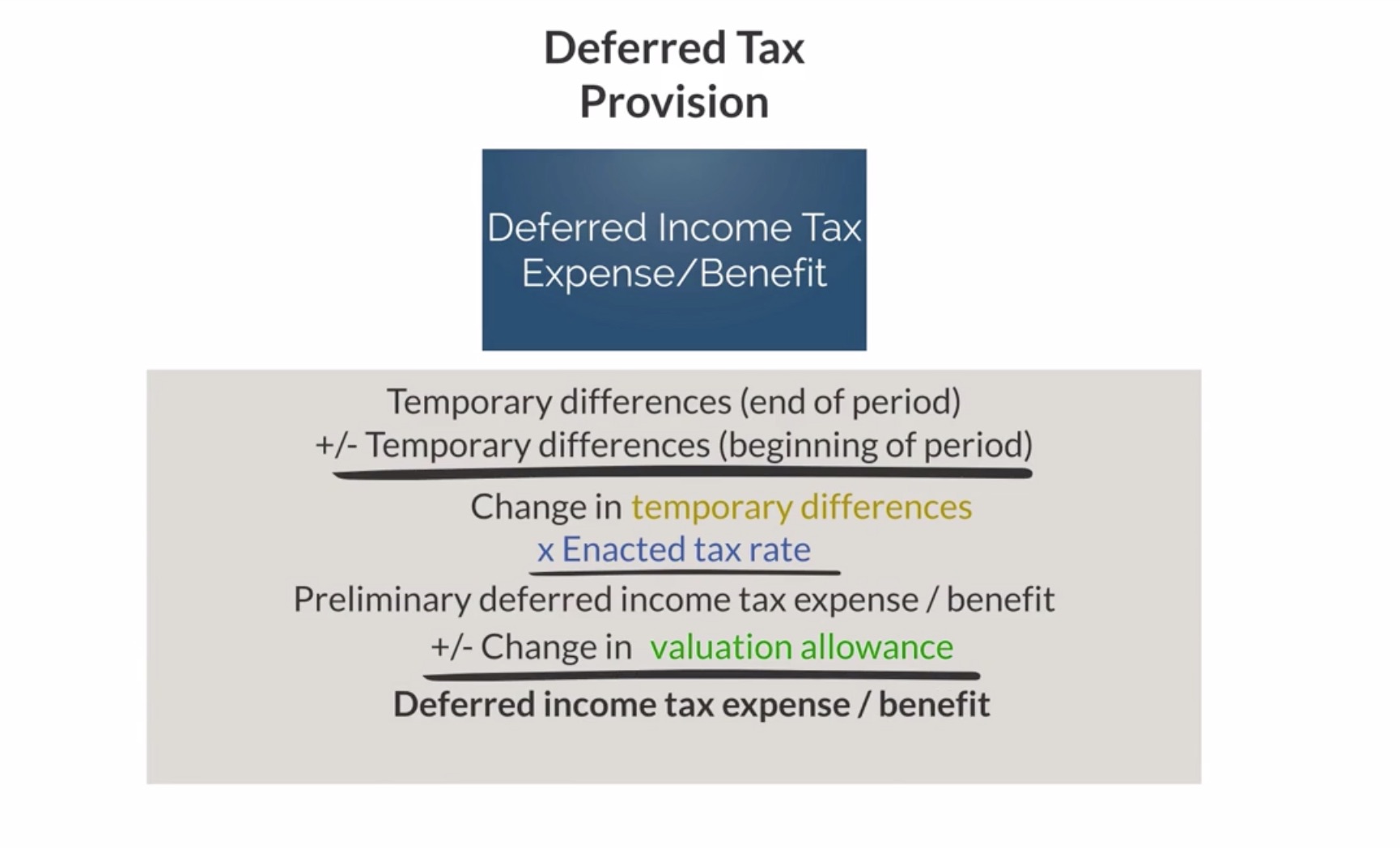

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

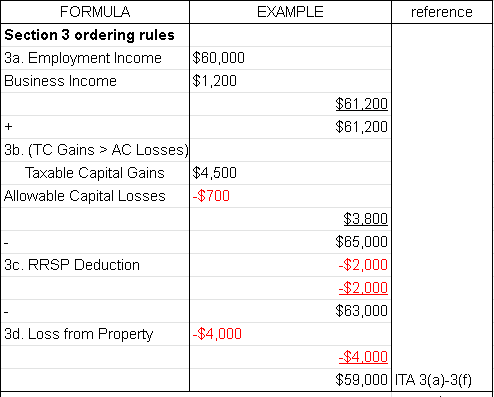

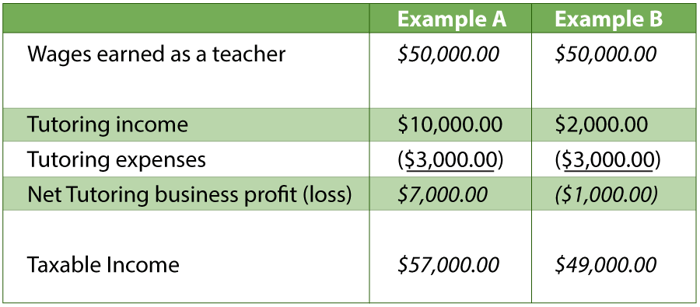

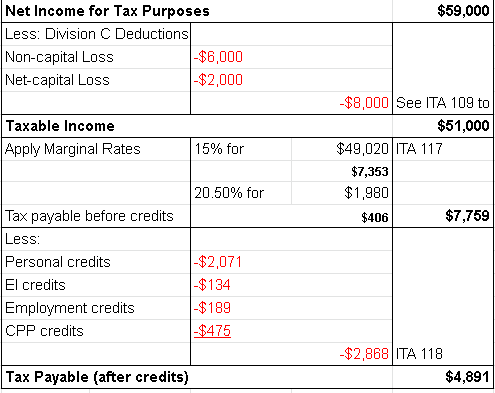

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

What Are Some Self Employed Tax Deductions In Canada

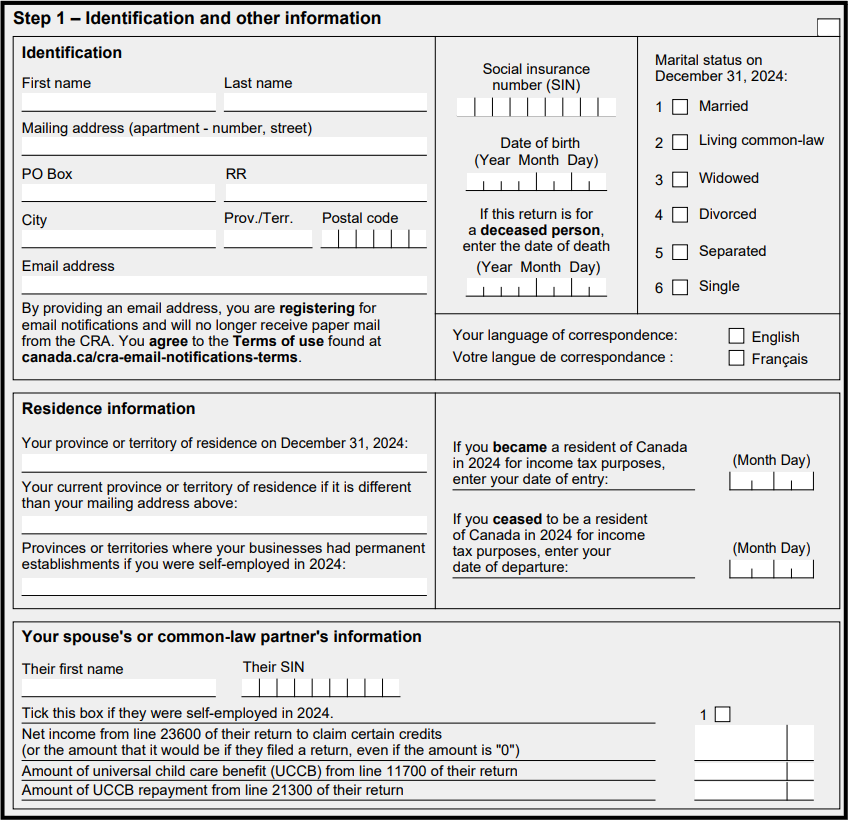

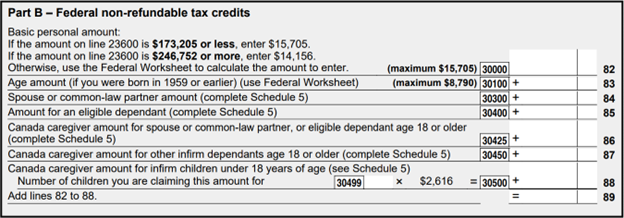

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

Tax Benefits Of Charitable Donations 2022 Turbotax Canada Tips

Interest Tax Shield Formula And Excel Calculator

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips